11+ dscr loan florida

No income verifications just a call and we can. No personal income used to qualify.

Dscr Loan Florida Quick Steps To Get The Loan

Borrow from 150000 to 3500000.

. 15 30 or 40 10yr IO 30yr PI Rate or 56 76. No-Income DSCR Loans in Florida. Maximum loan amount 5 million.

No limit on the. Buy the whole haystack instead of the needle. Qualify for a home loan without using your tax returns.

Purchase Refinance Cash-out loans. You must own your primary residence. Interest rate buy-down option available.

How Does DSCR Loan in Florida Work. HOA Dues 230mo. Lenders have different DSCR loan requirements and here are some qualifications that.

Get DSCR loan for investment properties in Pensacola Florida for 30000000 price range. No-income DSCR loans are popular financial instruments throughout Florida in large part because of the states very expensive housing. For the most part lenders will require a DSCR of 125 to qualify for DSCR loans in Florida.

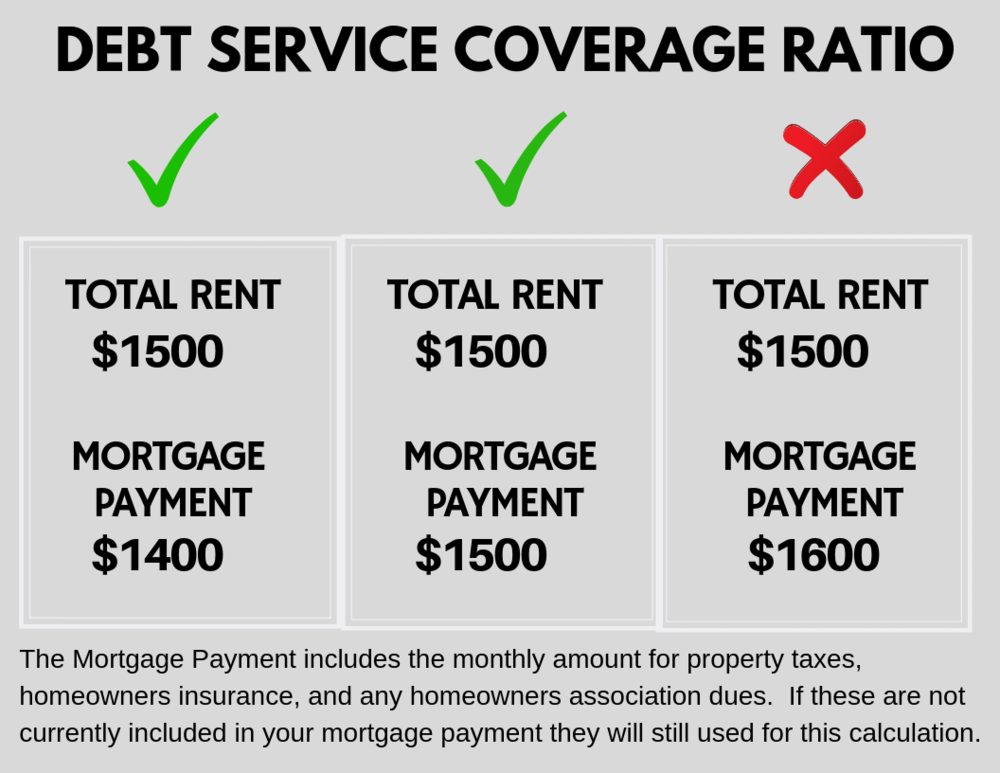

Qualifications based on property cash flow. A DSCR Loan is a Debt Service Coverage Ratio Program. In this example the DSCR 3000 Monthly Rent 2300 Monthly PITIA 13 coverage ratio.

The debt service coverage ratio measures the borrowers ability to pay back the yearly debt payment based on the assets NOI Net Operating Income. Get DSCR loan for investment properties in miami Florida for 40000000 price range. No income verifications just a call and we can.

As a real estate investor you can avoid high rates and high points of private. DSCR loans allow investors to be approved on the propertys income not their income. You must own your primary residence.

A Debt-Service Coverage Ratio DSCR loan is a top option for borrowers who want to use investment earnings rather than their personal income to qualify for a mortgage. The higher your DSCR is the more rental income you have to make your required monthly. DSCR Loan is a non-QM Qualified Mortgage loan implying that you dont have to go through the conventional mortgage.

Features of a DSCR Loan in Florida DSCR loans are attractive to real estate investors because of the considerable number of benefits and the array of features they provide including. No limit on total number of properties.

No Income Verification Dscr Loans For Rental Properties

1st Florida Lending I Custom Loan Programs

1st Florida Lending I Custom Loan Programs

![]()

Dscr Loan Florida How They Benefit Fl Property Investors Beacon Lending Nmls 2085418

![]()

Dscr Loan Florida How They Benefit Fl Property Investors Beacon Lending Nmls 2085418

No Income Verification Dscr Loans For Rental Properties

1st Florida Lending I Custom Loan Programs

![]()

Dscr Loan Florida How They Benefit Fl Property Investors Beacon Lending Nmls 2085418

1st Florida Lending I Custom Loan Programs

Dscr Mortgage Loans Debt Service Coverage Mortgage Loans

Dscr Mortgage Loans Florida Debt Service Coverage Ratio In Fl

Dscr Mortgage Loans Debt Service Coverage Mortgage Loans

1st Florida Lending I Custom Loan Programs

How The Dscr Requirement Affects Your Commercial Loan Sizing By Tim Milazzo Stacksource Blog

1st Florida Lending I Custom Loan Programs

Dscr Direct Lender Mortgages For Real Estate Investors

Dscr Florida Mortgage Lenders Use Rental Income To Qualify